An Unbiased View of Amur Capital Management Corporation

An Unbiased View of Amur Capital Management Corporation

Blog Article

Top Guidelines Of Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation for BeginnersAbout Amur Capital Management CorporationGetting My Amur Capital Management Corporation To WorkUnknown Facts About Amur Capital Management CorporationThe Single Strategy To Use For Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals Explained

The business we follow need a solid track document normally at the very least ten years of running background. This indicates that the company is most likely to have dealt with at the very least one economic recession and that administration has experience with misfortune along with success. We look for to leave out companies that have a credit rating top quality below financial investment quality and weak nancial stamina.A firm's ability to elevate returns constantly can demonstrate protability. Firms that have excess cash money ow and solid nancial placements often choose to pay rewards to bring in and compensate their shareholders. Because of this, they're often much less unpredictable than supplies that don't pay dividends. Yet beware of grabbing high yields.

The 4-Minute Rule for Amur Capital Management Corporation

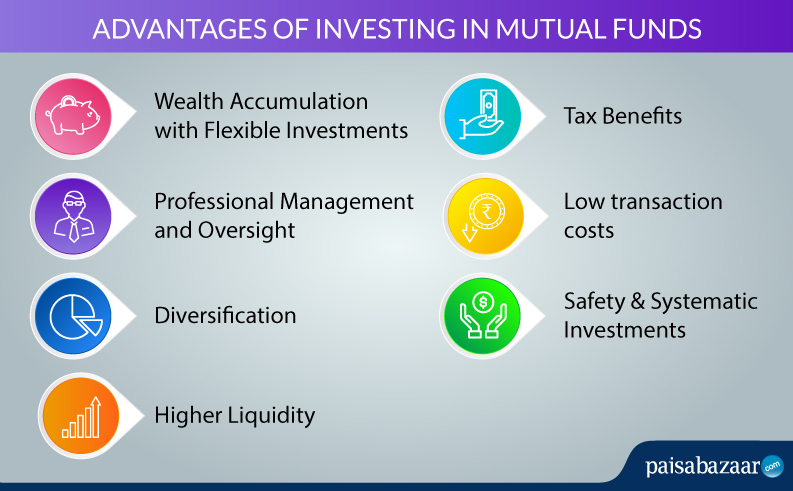

Expanding your financial investment profile can aid safeguard against market uctuation. Look at the size of a company (or its market capitalization) and its geographical market U.S - mortgage investment., established worldwide or arising market.

In spite of how very easy digital investment monitoring systems have actually made investing, it shouldn't be something you do on a whim. As a matter of fact, if you determine to get in the investing world, one point to consider is how much time you actually desire to invest for, and whether you're prepared to be in it for the long run.

Actually, there's a phrase typical connected with investing which goes something along the lines of: 'the ball might drop, yet you'll desire to ensure you're there for the bounce'. Market volatility, when financial markets are fluctuating, is a typical sensation, and long-term can be something to help smooth out market bumps.

Getting The Amur Capital Management Corporation To Work

Joe spends 10,000 and gains 5% returns on this investment. In year 2, Joe makes a return of 525, due to the fact that not just has he made a return on his preliminary 10,000, yet additionally on the 500 invested returns he has actually earned in the previous year.

Not known Incorrect Statements About Amur Capital Management Corporation

One way you could do this is by getting a Stocks and Shares ISA. With a Stocks and Shares ISA. passive income, you can spend up to 20,000 each year in 2024/25 (though this is subject to change in future years), and you do not pay tax on any kind of returns you make

Getting going with an ISA is actually easy. With robo-investing platforms, like Wealthify, the tough work is provided for you and all you require to do is select just how much to spend and pick the danger degree that suits you. It might be among minority instances in life where a much less emotional technique could be helpful, however when it involves your funds, you may wish to pay attention to you head and not your heart.

Remaining concentrated on your lasting goals could help you to stay clear of unreasonable choices based on your feelings at the time of a market dip. The tax therapy depends on your private conditions and might be subject to transform in the future.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

Nevertheless investing goes one action even more, helping you attain personal objectives with three substantial benefits. While saving means reserving part of today's money for tomorrow, investing means placing your cash to work to potentially make a much better return over the longer term - mortgage investment. https://gravatar.com/christopherbaker10524. Various courses of investment possessions cash money, dealt with interest, property and shares normally create different levels of return (which is relative to the danger of the financial investment)

As you can see 'Growth' assets, such as shares and residential or commercial property, have traditionally had the best total returns of all property courses however have likewise had larger optimals and troughs. As a financier, there is the possible to make funding development over the longer term in addition to a recurring earnings return (like returns from shares or rent out from a building).

See This Report about Amur Capital Management Corporation

Inflation is the ongoing surge in Check Out Your URL the price of living over time, and it can effect on our financial wellbeing. One means to help exceed inflation - and generate positive 'genuine' returns over the longer term - is by buying properties that are not simply qualified of delivering greater revenue returns however also supply the possibility for capital growth.

Report this page